Home Mortgage Options and Benefits for Teachers

Teachers are the backbone of society. As an educator, you mold the minds of future leaders. Yet (likely) because of your salary, you may need affordable housing. Buying a home anywhere, especially in metro areas, requires a lot of planning and patience. With rising housing costs, the largest hurdle most homebuyers face is finding a way to finance a home. But the good news is there are plenty of grants and home buying programs for teachers that can help make your homeownership dream a reality.

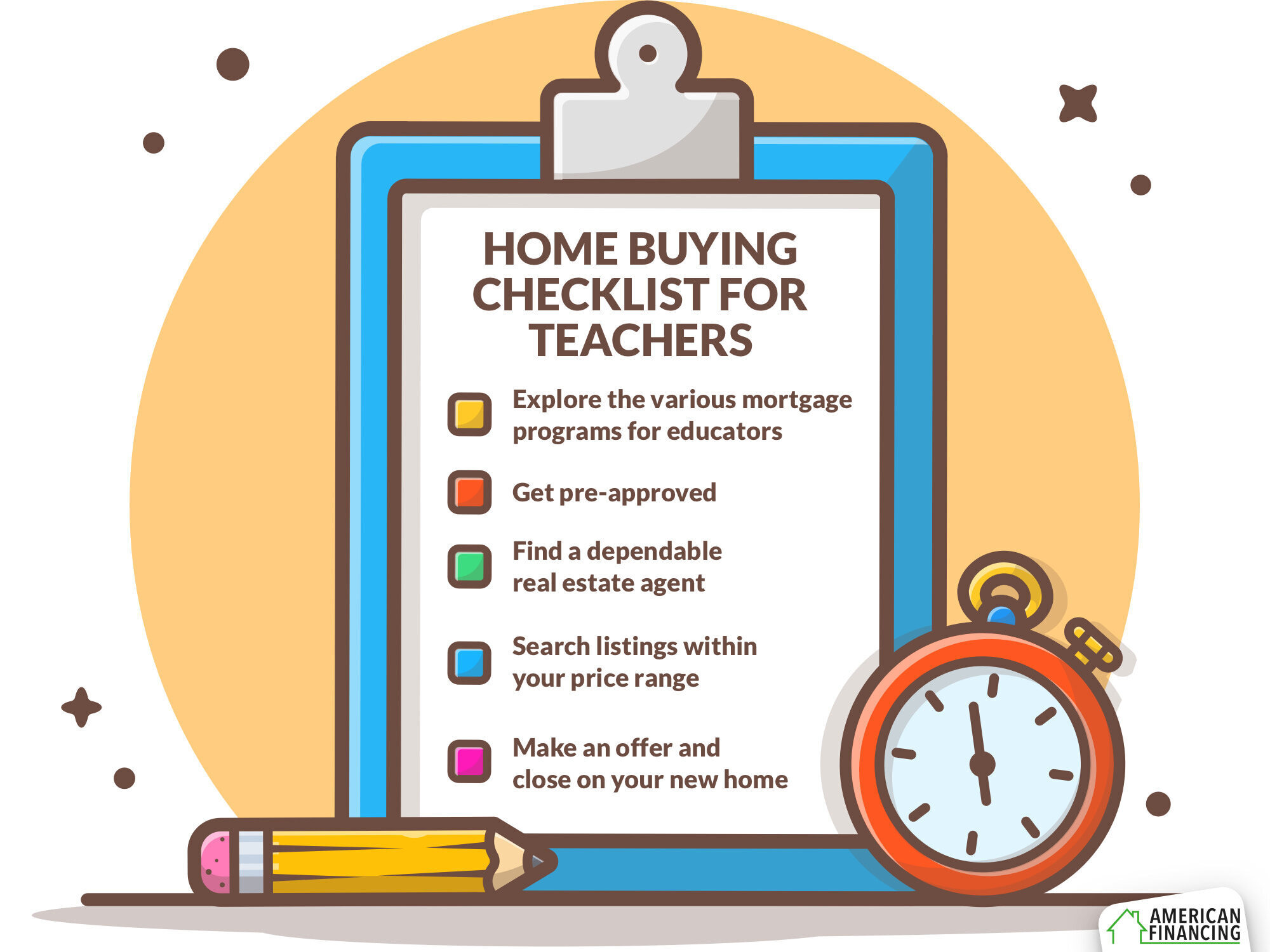

ABCs of home buying

The best way to start the home buying process is to meet with a mortgage lender. A lender can review your finances and help you determine how much you can comfortably afford on your salary. They can also go over down payment assistance programs to see what kind of grants you may qualify for.

Zero-down home loans

The House of Representatives introduced a mortgage program specifically for educators. Homes for Every Local Protector, Educator, and Responder, or HELPER Act, would be a zero-down loan program under the Federal Housing Administration. Those who qualify also wouldn't have to worry about monthly mortgage insurance.

First responders would benefit from the HELPER Act as well if it passes. We advise that firefighters, paramedics, EMTs, and law enforcement officers keep a close eye on the bill's status. According to The Mortgage Reports, there has been no update with it since it was referred to the House Committee on Financial Services in 2021.

Borrowers need to still meet certain requirements to qualify for the HELPER Act. Initial verbiage states that borrowers must be employed full-time and have been employed in their position for at least four consecutive years.

Mortgage programs for teachers

Good Neighbors Next Door

The U.S. Department of Housing and Urban Development (HUD) offers a variety of teacher home loan programs, including the Good Neighbors Next Door Program. This program was developed to help pre-kindergarten through 12th-grade teachers (and other public servant professionals) become homeowners. It offers a 50% discount on homes listed by HUD in return for committing to live in the property for 36 months.

How do you participate? First of all, check for eligible homes listed in your state. Then, follow the instructions to submit your interest in buying a specific home. If there are various parties interested in the same house, a random lottery selection will be held. In your case, make sure that you meet the specific requirements for a teacher and comply with HUD’s regulations for the program.

Teacher Next Door

HUD’s Teacher Next Door Program pairs educators with federal, state, and local home loan programs for teachers — including the Good Neighbors Next Door program. So how much money can someone who qualifies for the Teacher Next Door program receive? Well, it grants up to $4,170 for teachers and even $6,000 in some areas depending on the cost of living. Not only could you be eligible for the Teacher Next Door mortgage, but you may also have access to another $10,681 in down payment assistance. And there aren’t any upfront, application, or broker fees. But wait, there’s more! Other freebies include a free appraisal, homebuyer representation, access to MLS listings, nationwide access to foreclosures, discount title fees, and preferred interest rates. Teacher Next Door is designed to match the right educators with the right teacher mortgage loans.

Teacher Next Door Fresh Start

Perhaps your credit score is keeping you from obtaining a mortgage. If that's the case, spend some time exploring the Fresh Start Credit Repair Program. Just as its name suggests, Fresh Start works with teachers who need assistance overcoming their credit challenges.

The program is part of Teacher Next Door and continues to help teachers achieve their homeownership goals. We should also mention that consultations are free!

Homes for Heroes

Borrowers could save several thousand dollars when they buy a home with Homes for Heroes. The organization offers discounted costs and fees to first responders, teachers, and other heroes. Not all lenders are Homes for Heroes affiliates, so you'll have to find one in your area.

Landed down payment support

Landed is a company that invests alongside teachers and school staff when they are ready to buy a home in expensive cities like San Francisco, Denver, Los Angeles, and Seattle. It will provide you half of the down payment funds you need as long as you agree to share 25% of your investment when the time comes to sell.

Employees – including teachers, principals, bus drivers, custodians, and others – must have worked for the district for at least two years, and must agree to stay for two more. If they voluntarily leave before then, they have a year to pay Landed back.

Landed pays for its portion with more than $15 million in donations from foundations including the Chan Zuckerberg Initiative, funded by Facebook creator Mark Zuckerberg and his wife Priscilla Chan; and the Zoma Foundation, funded by Walmart heir Ben Walton and his wife, Lucy Ana.

If you are comfortable with the amount of money you bring in each month, but you don’t have enough upfront, companies like Landed may be an option.

Local programs

Check with your state for home loan teacher programs that aren’t offered federally. Many states offer similar home loans for teachers. In many cases, Teacher Next Door can connect qualified homebuyers with the appropriate grants and programs, but you can still search for mortgage loans for teachers that are unique to your state.

For example, Californian teachers can qualify for the Extra Credit Teacher Home Purchase Program (ECTP). This program grants eligible applicants a deferred, junior loan ranging between $7,500 and $15,000 depending on where the home is being purchased. ECTP requires that teachers be first-time homebuyers, employed in a county/continuation or high priority school in California, work in the same school for three years continuously and that a homebuyers education course is taken. So be on the lookout for teacher home buying programs specific to your state!

Other common teacher mortgage programs

FHA loans

There was a time when teachers could get better mortgage rates thanks to favorable deals from lenders. While these options may no longer be available, we recommend that educators consider an FHA loan. These government-backed home loans come with relaxed credit score requirements and as little as 3.5% down.

Don't hesitate to ask your lender about FHA loans for teachers and if one makes sense for you.

VA loans

There's a lot to like about VA home loans, including no down payment and no mortgage insurance for qualified borrowers. You can also benefit from today's low rates and refinance up to 100% of your home's value. The VA loan is available to active duty military, veterans, and qualified surviving spouses.

USDA loans

Let's say you reside in a rural area and are in need of a teacher down payment assistance program. While your mortgage options might be limited compared to other borrowers, you should definitely familiarize yourself with USDA loans. Eligibility is based on location and income, and your residence can be a condo, unit development, or single-family home.

The main benefit of USDA home buying loan programs for teachers is that you don't have to come up with a down payment. Plus, you don't have to worry about private mortgage insurance (PMI) breaking the bank. It all adds up to one of the most attractive teacher home loans in the industry.

Dedicated teacher housing

In some areas, available housing is set aside just for teachers. While it’s geared more toward renting, teacher-specific housing can provide below-market rates or rent discounts that can help you save for a home of your own.

In Dare County, North Carolina, teachers can sign up for affordable teacher housing through the Dare Education Foundation. Here, they offer units that rent below market value. Many states provide similar options for teachers who may not otherwise be able to afford to live in certain school zones.

An affordable apartment residence for teachers and nonprofits in Baltimore, called Union Mill, offers up to a $600 rent discount for teachers. Your local school district or teachers union should have more information on dedicated housing for teachers. Bottom line, the dedicated teacher housing option is a must for teachers preparing to buy a home and are looking for cost savings.

Spring shopping vs. offseason shopping

Given your work schedule, it may be easiest to start the home buying process after school lets out in early summer, but is it your best option?

There will still be many homes on the market to choose from, and some of them (depending on their list date) may offer price decreases. So, it certainly is a great time to start shopping, especially if you’ve already taken care of mortgage pre-approval or you have begun the process of securing a home loan.

Though you can also consider winter home shopping if you’re looking to relocate within your school district and you have time over winter break to make a move. Toward the end of the year, you could be looking at lower housing prices. There may not be as many homes on the market, but there’s also less competition, which can equal an incredible deal.

Denver housing market

In the nation’s top 28 housing markets, Denver ranks as the least affordable for teachers, according to a Redfin report. But not mentioned in the report are the different homes for teachers programs and grants available for those who qualify. If you’re a local teacher — or one relocating to the Denver area and are looking to buy home — there’s light at the end of the tunnel.

CHFA loans

Perfect for teachers in or moving to Colorado: the Colorado Housing and Financing Authority (CHFA) provides a loan program for Coloradan first-time homebuyers offering down payment assistance, affordable rates, closing cost support, and more. And, within the CHFA loan, there are a variety of programs that appeal to different borrowers and financial situations. Make sure to speak with a CHFA mortgage consultant to check on eligibility requirements for each individual program to see which one fits your needs.

Additional help for teachers buying a house

"Can you buy a house as a teacher?" It's a common question among educators these days, especially those looking to become homeowners for the first time. As we've discussed at length, there are special home loans for teachers.

This is where your lender comes into play. Keep in mind that not all mortgage lenders are created equal. Some charge fees to pre-qualify, and some work entirely on commission — so you could be forced into the wrong loan. That's why it's important to choose a lender who will create the right mortgage for teachers.

At American Financing, our team understands the ins and outs of teacher mortgage programs. We’re a family-owned, Colorado-based mortgage lender that’s been serving the community since 1999. We can use every loan in the industry: FHA, CHFA, VA, Conventional, just to name a few. Known for our excellent service, low rates, and fast closings — American Financing can put you on the surest path to homeownership.

Give us a call at (800) 910-4055 and ask us about mortgages for teachers!