How Higher Lender Fees Will Impact Your Mortgage Refinance

The refinance wave started in March as mortgage rates tumbled to historic lows. Fast forward five months and millions of homeowners could still benefit from a more favorable loan.

However, beginning Dec. 1, borrowers had something else to think about before moving forward with a refinance. Fannie Mae and Freddie Mac announced an increase in fees for lenders on conventional home loans.

Continue reading for a closer look at the adverse market refinance fee that caught everyone in the industry by surprise.

Alert: Federal regulators drop refinance fee

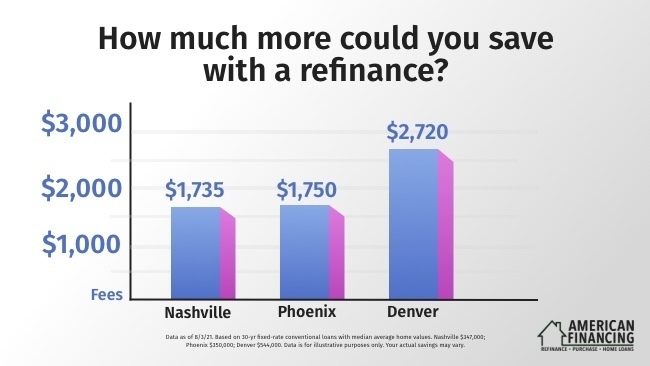

The Federal Housing Finance Agency announced it would be dropping the fee on all conventional loans delivered to Fannie and Freddie, effective Aug. 1, 2021. The decision is welcome news for homeowners who can now potentially save even more with a refinance. Keep in mind that your savings amount depends on several factors such as loan amount and how your lender originally accounted for the fee.

What’s the reason for the fee?

As we’ve mentioned in other articles, borrowers must meet stricter lending requirements during the coronavirus pandemic. Yet most people don’t realize that these government-sponsored entities take on a degree of risk even with “top-tier” borrowers. Fair or not, the surprise fee serves as added protection for the foreseeable future.

“They called it an adverse market fee,” said American Financing President Tim Hager in an interview with Denver’s KOA radio. “Basically, they put a 50-point basis fee on all lending. What that means is about $500 for every $100,000 borrowed would now be a fee that goes to Fannie Mae or Freddie Mac.”

So how does this affect your situation specifically? Unfortunately, you will likely be responsible for the adverse market fee in the event that you choose to refinance.

Your first thought may be to pay the fee in full at the time of closing. But this isn’t your only option. Hager explained that if you amortize the fee over the course of the loan, “you’re talking about under $10 a month.”

Said Hager: “Everybody’s case is going to be slightly different. What you want to do is just talk to a mortgage consultant. They’re going to look at your individual picture and figure out the best way to roll this (fee) in. Is it best just to amortize this across the entire loan? Is it best to take it as a fee at the beginning?"

As we’ll discuss later in the article, this is where working with a trustworthy lender comes into play.

Is there a way around it?

Not really. If you’re already in the refinance process and have locked your rate prior to this Fannie Mae and Freddie Mac announcement, you may be able to avoid the fee (depending on your lender).

All other borrowers who are in the conventional home loan refinance process (but have not locked their rate) should expect the fee to be applied to their loan. What’s more, application volume remains at an all-time high for lenders, meaning borrowers will need to get moving if they want to close on a new refinance by Dec. 1.

Of course, you have the option of getting a non-Fannie or Freddie loan. It’s a reasonable plan when you consider that plenty of lenders keep their loans in-house rather than sell them to these mortgage giants. Borrowers can also explore the possibility of going through the Federal Housing Administration for their loan.

Whatever you decide, know that Freddie and Fannie tend to offer the best deals for borrowers. And while it’s tempting to find a potential workaround, the reality is that you will end up paying fees wherever you go for your refinance. Make it a point to focus less on the higher lending fees and more on increasing your approval chances.

Plus, there’s the hope that this adverse market fee will be temporary, especially given the fact that the White House is reviewing it and the Mortgage Bankers Association is calling for a reversal.*

*Aug. 26 update: Loans with balances below $125,000 will be exempt from the fee. Additionally, it will not apply to loans made through Freddie Mac's Home Possible and Fannie Mae's HomeReady affordable refinance programs.

Can a mortgage refinance still save you money?

If you only take one thing away from this article, it should be that you can still benefit from a mortgage refinance. This holds true for borrowers wanting to shorten their term, drop mortgage insurance (PMI), or lower their rate. You might be able to save even more when you consolidate high-interest debt, such as credit cards and personal loans, into a low-rate mortgage.

“The good news is that interest rates are so low to begin with that it’ll be a minimal effect on most borrowers,” Hager said.

Pro tip: don’t assume that you’ll qualify for a refinance. Though a new loan could translate to significant savings for countless homeowners, you may need to bolster your financial profile first. Be honest with yourself and see what it takes to improve your credit score, lower your debt-to-income ratio, and boost your down payment amount.